Ohio Capital Finance Corporation

Expansion and new capital marked two of the accomplishments for OCFC in 2017. Led by the implementation of the OCFC’s 2016 Capital Magnet Fund Award from the CDFI Fund, OCFC provided 49 loans to affordable housing developers with total production exceeding $44,000,000 and assisting with the production and preservation of over 1,700 units.

The newly established $22,000,000 Capital Magnet Loan Pool provides construction and bridge loan financing to affordable housing projects with a goal of reducing the overall cost of construction and bridge financing by providing a 1.75% fixed interest rate to qualifying projects.

Additionally, OCFC received a Financial Assistance award of $686,500 from the CDFI Fund to allow OCFC to leverage additional private capital providing below market financing for projects seeking to transform neighborhoods.

OCFC’S product line continues to expand to meet the needs of affordable housing developers and provides a full range of services including predevelopment financing, acquisition financing, equity bridge / construction loan financing, and permanent financing.

OCFC operates four revolving loan funds:

– Ohio Affordable Housing Loan Fund

– Ohio Preservation Loan Fund

– OCFC Capital Magnet Loan Pool

– OCFC PNC Loan Fund

OCFC is a Community Development Financial Institution (CDFI) Entity, as certified by the United States Department of the Treasury.

Member of:

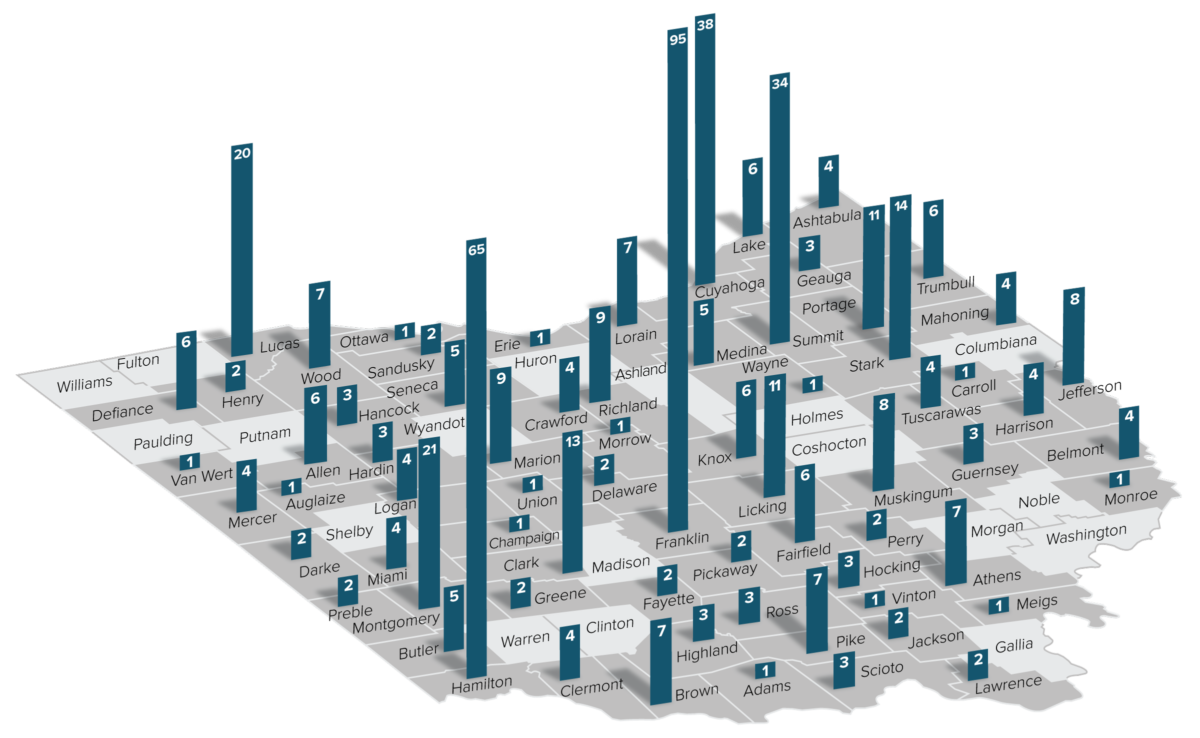

Ohio Loans by County

OCFC has provided loans in 80% of Ohio’s counties.

OCFC’s mission of “providing a flexible source of capital to increase and improve the supply of affordable rental housing across Ohio” has remained steadfast while expanding to meet market needs.

OCFC Investors

Since 2002, OCFC has generated over $451 million in 575 loans utilized to develop and preserve over 23,300 units of affordable housing across Ohio. OCFC is grateful to its investors and participants for their commitment to affordable housing while being mindful of the needs of its borrowers.

OCFC Investors & Participants

Fifth Third Bank$29,000,000

PNC Community Development Co.$11,000,000

First Federal of Lakewood$7,000,000

KeyCorp Community Development Corporation$7,000,000

National Coop Bank$6,450,000

Nationwide Bank$6,000,000

First National Bank of PA$5,800,000

Huntington Community Development Corporation$5,000,000

John D. and Catherine T. MacArthur Foundation$4,000,000

Ohio Housing Finance Agency$4,000,000

US Bank Community Development Corporation$3,500,000

WesBanco$3,500,000

First Financial Bank$1,000,000

RiverHills Bank$1,000,000

WoodForest Bank$1,000,000

First State Bank$500,000

CF Bank$250,000

Total$106,550,000

Accomplishments 2002-2017

Units financed (31% of which were preservation)

Loans closed

Total loan production

OCFC has provided loans in 80% of Ohio’s counties

OCFC received a $686,500 CDFI Financial Assistance Award that will be utilized to provide additional resources for nontraditional loans that will positively impact neighborhoods.

OCFC leveraged a $4,800,000 CDFI Capital Magnet Fund Award to establish the $22,000,000 OCFC Capital Magnet Loan Pool, which will provide below market rate financing for affordable housing developers in Ohio.

Loan Production Distribution

Number of Loans

Hover over the pie chart for more details about each loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

Permanent

Amount of Loans

Hover over the pie chart for more details about each loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

Permanent